8 Ways States & Counties Could Score Broadband Grants

State level governments are in an unprecedented position as 2022 commences: They're poised to receive and deploy $65 billion to get all of their constituents -- regardless of income or location -- plugged into our information society.

Broken down, that’s $42.5 billion for broadband infrastructure rollout, $14.2 billion for broadband affordability subsidies, $2.75 billion for the Digital Equity Act, and $1 billion for middle mile infrastructure. The remaining sums are going to supplement Tribal broadband connectivity, and to beef up the United States Department of Agriculture’s ReConnect Loan and Grant Program.

The scale of the funding is unprecedented. But the approach to wiring up the nation is also unique. For the first time it will be the states -- not the federal government -- that will be closely managing the game-changing-sized grants to Internet Service Providers and their potential public partners in local government. There is also a significant emphasis on soliciting input from local communities and governments on where those networks should go.

The vehicle for this windfall is the Infrastructure and Investment and Jobs Act of 2021.

As required by law, President Joe Biden’s administration will formally ask states to submit five-year broadband buildout plans sometime this May. So state officials' planning and wishlist-making process (within the requirements of the law) begins now.

For now, the below list is scoring criteria that we think state broadband officials ought to consider when making grants to public-private partnerships or regions looking to develop broadband networks. We’ve scoured state documents and broadband annual reports, consulted industry experts and talked to the Pew Charitable Trust for these ideas.

Internet Service Providers can promise speeds of “at least” 100/20 Mbps as required by federal funding legislation, but ultimately performance is determined by the concept of latency as well.

Network performance can change based on anything that ranges from the way software designers design their products to be bandwidth intensive, to the number of people in a household or region doing tasks that range from videoconferencing, gaming or streaming video or even performing a remote surgery in a hospital.

As former FCC Commissioner and USDA Administrator Jonathan Adelstein told Congress last summer:

“Applications are very provider specific and geographically specific. The unique history of network investment in a particular service area dictates feasibility along with the financial and technical strength of the operator proposing to provide service.

Two areas similar in geography and density may not have similarly strong providers or existing networks from which to extend further into rural areas. For example, there may be an area in West Virginia that is similarly rugged and sparsely populated to one in Montana. However, one might have a local cooperative that has long invested in building out fiber connectivity, with a solid balance sheet girded by years of RUS and Universal Service funding, while the other has not benefited from similar investments in infrastructure, or have a similarly strong local provider.”

If grant offices place unrealistic expectations and assumptions upon grant applicants, target areas “may go unserved – or worse, become unserved when the provider is unable to cover its costs due to limited ongoing customer revenues after it is built at taxpayer expense,” he warned.

Adelstein is currently the Wireless Infrastructure Association’s President and CEO.

1. Access and Affordability

In states with municipalities with a history of disinvestment, applicants should explain how their project makes broadband accessible in terms of price, timely provisioning and quality of service to large groups of people in low-income areas. The IIJA also prioritizes areas that are afflicted by persistent poverty.

For example, grant applicants might have to demonstrate how they would work with public housing authorities to provision areas that are documented to have been digitally redlined, like in cities such as Baltimore, Cleveland, Dallas, Detroit, Los Angeles, Oakland.

They’d have to provide partnership contacts and specific implementation plans. If this is a big factor within a state, it might de-emphasize scoring or deprioritize scoring for broadband speed requirements slightly.

For example, the Los Angeles public housing authority addressed the lack of service for its residents by signing a deal with Starry Connect. The company installed a fixed wireless, 30Mbps symmetrical service to over 5,000 units across nine different public housing sites.

“Instead of tying service to an individual -- which traditionally has required ISPs to perform credit and background checks -- Starry provides service based on an address. After a six-month free trial during the initial launch period, the service costs $15 a month. Starry so far has covered about 1,000 units,” reported CNET in a 2021 story about digital redlining.

Speed of deployment might also be a consideration here. If there are a significant portion of children in a population that need access to the Internet for school, timeliness could also be included in this metric. It’s a factor that’s mentioned in the IIJA.

In comments to the NTIA, the National League of Cities Legislative Director for Technology Angelina Panettieri worried about the impact of flawed mapping data.

“How can we address those disinvestments and ensure in particular that urban and suburban, and lower income communities are not inadvertently blocked from IIJA’s Broadband Equity, Access & Deployment program due to the prioritization system, or left with lower quality infrastructure options by state plans?” she asked.

She also worried about quality of service and cost.

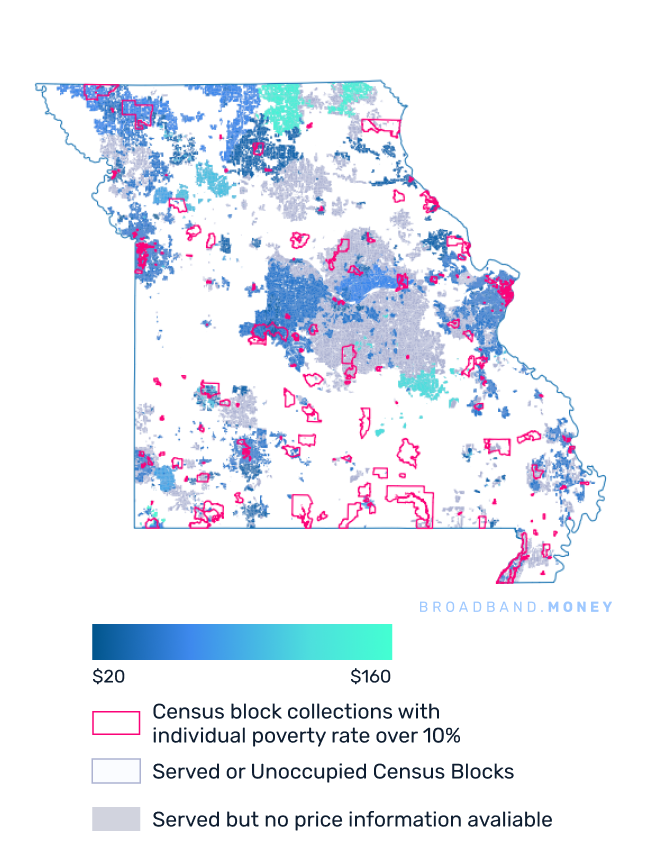

Map1: Internet price for minimum 100/20 Mbps offering for Missouri. This is a map of served areas per NTIA’s speed definition (download/upload ≥100/20 Mbps). Only census blocks with reported internet speeds of 100/20 Mbps are shown. Color represents available price information from the “cheapest” offer for at least 100/20 Mbps. Grey areas either do not have price information, or we could not locate any provider that offers such residential packages at the promised speed. The red lines are the locations with individual poverty rate over 10%

Here is the plot of poverty status vs. monthly price. In locations with high poverty rates (over 30%,) are the subscriptions affordable? Scatter plot of price distribution vs. number of ISPs in any census block in Missouri.

2. Financial Feasibility: Measure Yield on Cost (YOC)

Once funded by a grant, how will grantees make the numbers work?

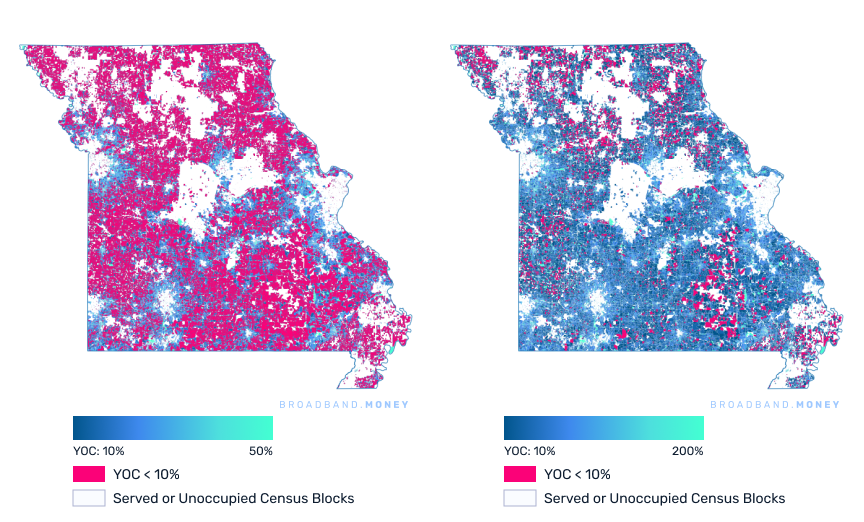

Map 2 below introduces yield on cost estimates for the state of Missouri and illustrates one type of financial analysis that can support grant applications.

The left map represents estimates without grants, and the right map illustrates distributions covered by grants.

Map 2: Yield on cost (YOC) estimates for Missouri assuming all places are serviceable through fiber. YOC is calculated using estimated net income divided by fiber construction cost. The fiber construction cost is estimated using the number of households and road miles. The number of households is provided by a 2020 Federal Communications Commission estimate.

Road miles are calculated from OpenStreetMap. Left (a) shows the YOC of each census block without any grant support. All red areas are locations that will have a YOC below 10%. On the right, we assume the grant would cover around 75% of the construction cost, and re-compute the YOC.

All white regions are census blocks that either already have 100 Mbps/20 Mbps service or not occupied by any households. (Take rate assumption at 40%)

- Applicants must submit a project narrative that describes in detail how the award would be executed and what anticipated revenue timelines are.

- The application should explain the scope of the project, the budget, including a detailed breakdown of the costs associated with each budget line and any additional necessary details.

- What kind of network and system design will be built (aerial fiber or in the ground?) and what will the procurement process be for that?

- What are the applicant’s exact buildout obligations?

- What is the applicant’s income statement, and cash flow?

- What percentage of eligible project costs are being requested? (The lower the higher score the project will receive)

- What kind of institutions are matching the grant? Wisconsin, for example, “prioritizes grant applications if an Internet Service Provider partners with a local community that provides matching funds and serves areas that are completely unserved, can be scaled to provide more services to more people or at a faster speed, support economic development,” according to a report from The Pew Charitable Trusts.

- What are the applicant’s financial covenants, if applicable?

- What will the applicant’s anticipated labor costs be given the labor requirements under the IIJA?

- What engineering firm will the applicant hire and how much experience do they have building networks similar to the one proposed?

- Has the applicant accounted for the IIJA’s net neutrality requirements and what these might mean for its bottom line?

- How many miles of fiber will or wireless towers be required, and homes and businesses passed, and at what cost? What are the applicant project’s anticipated take rates?

- If the applicant is operating in a sparsely populated area, has it considered alternative business or financial models, such as user-owned broadband utility networks?

3. Outsmarting Obsolescence

The applicant should explain how its network is easily upgradable for any potential growth or change in usage.

Grants officers should consult with network design experts to thoroughly understand the mechanics of internet performance and end-user experience beyond relying on an applicants’ promises of upload and download speeds. They should also consult with each other and industry groups to work on coming up with better ways to measure how networks perform under a variety of conditions.

For example, the Broadband Internet Technical Advisory Group in January 2022 published a white paper on the concept of latency – what it is, why it matters, and how different online activities – such as Voice and video conferencing, multiplayer online gaming – respond to, and are affected by it.

What would it take to expand capacity and latency to accommodate growth or surges in traffic, as we saw over the COVID crisis?

This might be especially applicable to providers of wireless broadband solutions as bandwidth demands grow with time.

4. Degree of Difficulty

Costly obstacles facing connectivity efforts include building on difficult terrains, make-ready costs, and building in disaster-prone areas.

“One of the most significant barriers that we face within the Department of Education is building infrastructure on certain terrains or the right to access lands,” said Ali Dias from the California Department of Education. “Nobody wants to spend the money … or put the time in to build on some of the terrain up in the mountains or lands where there's common landslides and the infrastructure gets wiped out.”

But there are some county offices of education and schools that need broadband in these areas.

Another commenter added that they faced similar building issues in the Adirondack Mountains in Upstate New York, where he anticipated that the only solution would be satellite Internet.

States might want to award more points in these kinds of areas to creative solutions that attempt to tackle these issues of terrain. New York State Governor Kathy Hochul announced in January that the state plans on issuing competitive grants to projects that “pilot and construct creative, innovative, and new solutions pioneering future breakthroughs,” for example.

California, for example, does use terrain as a factor in its scoring criteria for grants from its California Advanced Services Fund. The state has been focusing on broadband since the 1990s and tying it into economic development and other issues.

One grant application form says that the California Public Utilities Commission will take into account if a project proposed to cover an area that “contains rugged or difficult terrain (e.g., mountains, desert, national or state forest.)”

The IIJA does factor remoteness and topography into its definition of what a “high cost area” is, and how that affects grants applicants’ chances of receiving funding.

State lawmakers, if they don’t have the power to eliminate all these barriers themselves, should make a checklist of barriers that grant applicants might face and ask them how they will overcome them. (Sometimes some state departments don’t talk to each other.) In New York State’s case, Hochul announced that for her ConnectAll Initiative would remove fees, “outdated” regulatory hurdles and leveraging state assets.

This includes a set of reforms not limited to:

- A Build-Free Initiative for Rural Broadband Deployment: Eliminate state use and occupancy fees that hinder rural broadband deployment directing the Department of Transportation to exempt ConnectALL projects, reducing costs for program participants.

- Streamline Make-Ready Processes: Direct the Department of Public Service (DPS) to streamline the current make-ready process.

- Standardize Right-of-Way Access for cellular and fiber deployments

- Establish Clear Timelines: Establish clear permitting timelines for cellular and fiber deployments on state land and rights-of-way with simple and standardized forms and processes.

- Leverage Existing State Fiber Assets: Conduct a pilot to leverage existing State fiber assets to support middle-mile broadband.

5. Inclusivity/Stakeholder Engagement

Most of the states successfully leading the way in rolling out broadband grant programs have developed strong and varied relationships with stakeholders who advocate for what they want out of a broadband network, and they look for coalition building from grant applicants. Not only does this determine the kind of network that’s built. It can also help with funding efforts and take rates.

For example, Minnesota’s Governor formed a Taskforce on Broadband in 2011 that included ISPs, businesses, local governments, healthcare facilities, tribes, and educational institutions.

Maine and North Carolina also have strong grassroots broadband coalitions. In a sense, it’s a form of demand aggregation, a way for applicants to define their markets.

California has various regional consortia that apply for grants.

"The consortia are a mechanism to build a bottom-up strategy and have a way to connect with the state and create a state-regional partnership or a state and federal partnership," Trish Kelly, managing director of Central Valley-based Valley Vision, told Pew.

One participant in NTIA’s December listening session also pointed out that local stakeholder groups may have better information than the federal agencies.

“We have a website called Connecting Appalachia, where we partnered with other regional councils in Appalachia, to truly show the wide range that was missed in the old FCC maps,” Ryan Collins, Broadband Coordinator from the Buckeye Hills Regional Council, told the NTIA. The council is a regional group of governments in Southeastern Ohio, primarily focused in eight Appalachian counties in southeastern Ohio.

And Maine’s Governor Janet Mills swore in Andrew Butcher as the state’s president of its broadband authority at the beginning of 2022. He had previously led the Maine Broadband Coalition, an organization that represents and advocates for businesses, communities, and internet users to secure affordable and equitable access to broadband connectivity.

North Carolina encourages regions looking to develop broadband networks in their areas to form broadband planning committees.

“Your broadband planning committee should be representative of your entire community, incorporating committed stakeholders who will benefit greatly from broadband access,” reads the playbook.

6. Economic Impact

Broadband is a proven driver of economic development and states will be keen to see how grants will help drive economic activity.

Some states include specific economic impact criteria. For example, Wisconsin’s Public Service Commission’s broadband expansion grant application template for this year asks for “a description of how the proposed project will promote job growth or retention, expand the property tax base or improve the overall economic vitality of the municipality or region.”

The state says that applicants can include testimony about the impact from individuals or businesses. The state says that it will be looking for:

- A discussion of potential economic impact the project could have for an

- individual business located in the project area.

- An explanation of how an improved download and upload transmission

- speed could better support a specific business in the project area.

- An explanation of the likely impact improved broadband service could

- have on residential property values, supported by local sales data if

- available.

- A demonstration of how improved broadband service to a residential

- portion of the project could benefit a telecommuting population.

- A demonstration of how the speeds and service being offered by the

- project fits with current and future economic needs of the community and local businesses.

A glance through local news outlets for past couple of years shows hundreds of stories of small business owners who suffered when the lockdown occurred and they were stuck at home with little access to broadband.

Map 3. Business Distribution and Broadband Service: a. Map of business distribution in Missouri at zip code level in 2018 reported by U.S. Census Bureau (Social Explorer https://www.socialexplorer.com/explore-tables). b. Business distribution within underserved project zip codes. Underserved project zip codes are those with more than 80% of households unserved (Internet speed below 25/3 Mbps) or underserved (100/20 Mbps). As of the 2018 report, there are 11,535 business establishments (7.7% of total businesses in MO) across all sectors within the underserved project areas.

Map 4. Business Size Distribution and Broadband Service: a. Map of “Small” business distribution at zip code level in 2018 reported by U.S. Census Bureau (Social Explorer). Here the “Small” business refers to any business with fewer than 10 employees. As of the 2018 report, a total of 128,432 businesses (85% of total business in MO) in MO have fewer than 20 employees. b. Rank of businesses within underserved project areas. A relatively larger proportion of small businesses tend to cluster around underserved project areas than large businesses. Around 8.4% of smallest businesses (1-4 employees) locate within underserved project areas.

Grant applicants could receive more points if they can provide data on the scale of the economic impact they could have on the proposed region.

7. Accountability

Accountability and a willingness to comply with these requirements should be another criteria that states consider. The IIJA contains several provisions designed to make grant applicants accountable for the money they receive.

For example, it requires the NTIA to publish grant reward information online. It also requires grant recipients to file regular progress reports every six months one year after they are awarded the grants.

The reports need to document how grant recipients are spending the money, what service is being provided, and the number of homes to which the broadband networks have been made available, as well as the number of households actually subscribing to the services.

Some states have already implemented rigorous accountability measures.

California, for example, also requires semi-annual progress reports. Its application template also specifies what information grant recipients must include.

This includes:

- Information on major construction milestones

- Problems and challenges encountered

- Subscription information and certification that each report is true and correct under penalty of perjury.

- Comparison of approved versus actual costs of construction

- Description any changes in the project construction than those promised

- Both the number of low-income customers in the project area and the number of low-income customers subscribing to low-income plans

- Numbers on projected subscribers versus actual subscribers (by subscriber type) as of the date of the project’s completion.

Grant recipients are also required to submit specific speed test data at the address level for project areas, as well as a “representative sample of speed test results at dispersed locations in the project area, including locations at the edge of the project area.”

The grant recipients must also provide a verifying screenshot of test results using the state’s Internet speed testing tool name CalSPEED.

Meanwhile, Colorado requires grant recipients to demonstrate that they’ll be able to operate their networks for at least five years, among other things.

Tennessee’s grant applications process gives more points to applicants that have programs to push broadband adoption among subscribers. This was a response to the state’s sluggish take rates.

8. Project Readiness

Many states also require grant applicants to demonstrate that they’re ready.

Some states try to help in this regard by asking grant applicants to certify themselves as “broadband ready communities.” Indiana is one of them.

Meanwhile, the Pew Charitable Trusts reports that Colorado funds broadband grants in two phases.

“The first phase requires grantees—generally regions—to complete a strategic plan for broadband deployment. This phase helps communities define goals, understand their existing assets, aggregate demand across the region, and examine potential solutions, including private ownership and public-private partnerships. The Department of Local Affairs requires that grantees invite providers to participate in the planning process, providing opportunities for communities to explore partnerships or learn where providers might be planning or willing to extend their service.”

Pew also points to the multi-step process that Maine’s ConnectME Authority puts grant applicants through before they can receive any infrastructure funding. For example, grant applicants must complete a pre-certification checklist before they can even apply for planning grants, which have similar requirements to Colorado’s planning process.

The key takeaway here is, Pew says: "The planning process engages local communities and builds the capacity needed to apply for support for infrastructure projects that meet community needs.”

Conclusion

State officials must come up with grant making criteria as they ponder their specific goals and as they re-evaluate which areas of their territories have been neglected by incumbent commercial broadband providers. This 8-point guide could prove beneficial to this process and Broadband.money will continue to offer insight into this historic opportunity to bring universal broadband access to every corner of America.